Short Course on – Covering The Basics

Navigating the Complexities of Personal Bankruptcy: A Guide to Understanding Your Options

Navigating the Complexities of Personal Bankruptcy: A Guide to Understanding Your Options

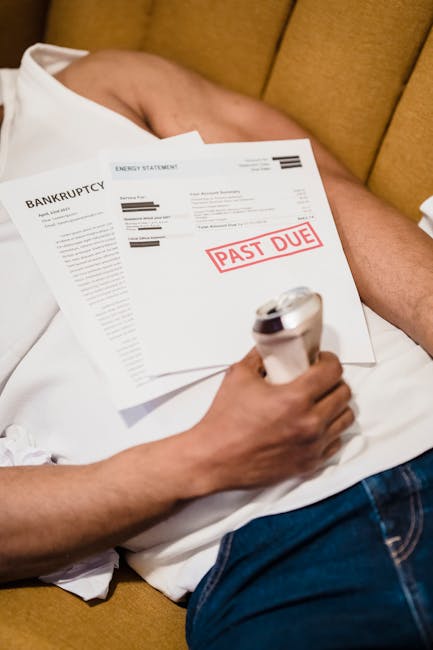

Filing for personal bankruptcy can be a daunting and overwhelming experience, especially for those who are unfamiliar with the process. With the rising costs of living and the increasing burden of debt, many individuals are finding themselves in a situation where they are struggling to make ends meet. If you are facing financial difficulties and are considering filing for personal bankruptcy, it is essential to understand your options and the implications of each.

One of the most critical steps in navigating personal bankruptcy is to understand the different types of bankruptcy that are available. In the United States, there are two primary types of personal bankruptcy: Chapter 7 and Chapter 13. Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves the sale of non-exempt assets to pay off creditors. This type of bankruptcy is typically used by individuals who have few assets and a significant amount of unsecured debt, such as credit card debt or medical bills. On the other hand, Chapter 13 bankruptcy, also known as reorganization bankruptcy, involves creating a repayment plan to pay off a portion of your debts over a period of three to five years. This type of bankruptcy is typically used by individuals who have a steady income and want to keep their assets, such as a home or car.

When considering personal bankruptcy, it is essential to understand the eligibility requirements for each type of bankruptcy. To be eligible for Chapter 7 bankruptcy, you must pass a means test, which determines whether you have the means to repay your debts. The means test takes into account your income, expenses, and debt obligations to determine whether you qualify for Chapter 7 bankruptcy. On the other hand, Chapter 13 bankruptcy has no eligibility requirements, but you must have a steady income and a manageable debt load to qualify.

Another critical aspect of personal bankruptcy is understanding the process of filing for bankruptcy. The process typically begins with a consultation with a bankruptcy attorney, who will help you determine which type of bankruptcy is best for your situation. Once you have decided on a type of bankruptcy, you will need to gather financial documents, such as income statements, expense reports, and debt obligations. You will then need to file a petition with the bankruptcy court, which will trigger an automatic stay on your debts. This means that creditors will be prohibited from contacting you or attempting to collect debts while your bankruptcy case is pending.

One of the most significant benefits of personal bankruptcy is the automatic stay on debts. This can provide a significant amount of relief for individuals who are facing harassment from creditors or are struggling to make ends meet. Additionally, personal bankruptcy can provide a fresh start for individuals who are overwhelmed by debt. By discharging certain debts or creating a repayment plan, individuals can start rebuilding their credit and moving forward with their financial lives.

However, personal bankruptcy is not without its drawbacks. One of the most significant consequences of personal bankruptcy is the impact on your credit score. Filing for bankruptcy can significantly lower your credit score, making it more difficult to obtain credit in the future. Additionally, personal bankruptcy can remain on your credit report for up to ten years, making it a long-term consequence of filing for bankruptcy.

Another important consideration when filing for personal bankruptcy is the potential impact on your assets. In Chapter 7 bankruptcy, non-exempt assets may be sold to pay off creditors. This can include assets such as a second home, investments, or other valuable possessions. In Chapter 13 bankruptcy, you may be required to surrender certain assets as part of your repayment plan. It is essential to understand which assets are exempt and which may be at risk when filing for personal bankruptcy.

In addition to the potential impact on your credit score and assets, personal bankruptcy can also have emotional and social consequences. Filing for bankruptcy can be a stressful and overwhelming experience, and it may be difficult to discuss with friends and family. Additionally, personal bankruptcy can affect your ability to obtain credit or loans in the future, making it more difficult to achieve long-term financial goals.

Despite the potential drawbacks, personal bankruptcy can be a valuable tool for individuals who are struggling with debt. By understanding the different types of bankruptcy, the eligibility requirements, and the process of filing for bankruptcy, you can make an informed decision about whether personal bankruptcy is right for you. It is essential to consult with a bankruptcy attorney and to carefully consider your options before making a decision. With the right guidance and support, personal bankruptcy can provide a fresh start and a new beginning for individuals who are struggling with debt.

A 10-Point Plan for (Without Being Overwhelmed)

This post topic: Health Care & Medical